In the fast-moving world of international homeware sourcing, ceramic bowls are among the most in-demand items for kitchenware retailers, gifting companies, and cross-border e-commerce sellers. But while style, finish, and MOQ all influence a buying decision, few factors have as big an impact on profitability as tariffs.

Understanding the complexity behind import tariffs helps buyers avoid surprise costs, ensure pricing competitiveness, and build longer-term supplier relationships. Whether you’re sourcing minimalist ramen bowls or colorful cereal sets, being aware of how duties work—and how to reduce them—is essential.

In this blog, we’ll explore three key tariff factors that influence ceramic bowl imports and how smart importers can respond strategically.

1. MFN vs. General Tariff Rates: The Country of Origin Matters

Every ceramic bowl has a backstory—not just in design, but in trade classification. Countries often operate under Most-Favored-Nation (MFN) agreements, offering lower import duties on goods shipped from partner countries. By contrast, goods from non-MFN or unlisted nations may be subjected to higher general tariffs.

For example, a European giftware wholesaler importing 3,000 ceramic soup bowls from an MFN partner like China may face a tariff of around 8%. But the same shipment from a non-MFN country could attract 20–30%, drastically altering pricing and margins.

Key tip: Always verify MFN status and trade agreements before placing large-volume orders. Even within Asia, different countries are subject to different duty schedules depending on bilateral relations.

2. HS Code Classification: What You Call It Affects What You Pay

Many buyers don’t realize that small changes in product descriptions during customs declarations can reclassify ceramic bowls under different HS (Harmonized System) codes—and significantly affect the duty rate.

For instance, the tariff for a ceramic bowl used for dining might differ from one used decoratively. Similarly, unglazed stoneware is treated differently from fine porcelain in many customs systems.

Here’s a breakdown of how HS codes affect duty rates across common ceramic bowl types:

| Bowl Type | HS Code | Typical Use | Avg. Import Duty (US/UK) |

|---|---|---|---|

| Porcelain Soup Bowls | 6911.10 | Dining sets, table service | 5–6% |

| Stoneware Cereal Bowls | 6912.00 | Everyday kitchenware | 8–10% |

| Earthenware Mixing Bowls | 6912.00 | Prep and baking | 10–12% |

| Decorative Ceramic Bowls | 6913.10 | Display, gifting | 3–7% |

| Hand-glazed Fruit Bowls | 6912.00 | Serving centerpiece | 8–10% |

Why it matters: Misclassification can delay customs clearance, incur overpayment, or result in compliance penalties. Always consult a customs specialist or review tariff databases when listing products.

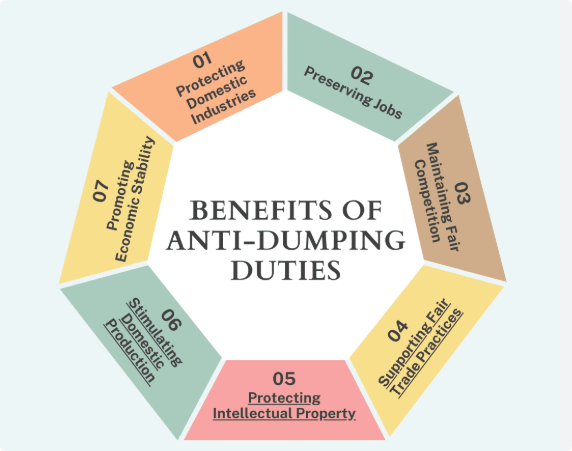

3. Anti-Dumping Duties and Sudden Policy Shifts

Beyond standard import duties, anti-dumping duties (ADD) can be applied to ceramic bowls if they’re believed to be exported below fair value. These duties are especially relevant for importers dealing with low-cost mass production orders.

Let’s say a cross-border seller orders 10,000 stoneware salad bowls from a supplier in a country flagged for dumping by the importing country. ADD rates can jump up to 50% or more, completely wiping out cost advantages.

Complicating things further, tariff rates can change suddenly due to political disputes or shifts in trade policy. For instance, US-China trade tensions in past years led to the imposition of Section 301 duties on many ceramic items, disrupting entire supply chains.

What importers can do:

- Stay updated on trade news via official customs channels.

- Work with suppliers in countries less prone to trade tensions.

- Use Free Trade Zones (FTZs) to delay tariff payment until goods are officially sold.

Navigating Ceramic Bowl Sourcing with Tariff Strategy in Mind

Whether you’re importing elegant ceramic salad bowls for an upscale homeware line or practical rice bowls for e-commerce resale, tariffs should be part of your sourcing conversation from day one.

Consider how your product is classified, where it’s produced, and whether trade restrictions or anti-dumping policies might apply. A little foresight during procurement can prevent major headaches down the line.

Here are a few tips for ceramic bowl importers looking to remain competitive:

- Always ask suppliers for their HS code and check it independently.

- Build a tariff buffer into pricing, especially for seasonal or high-volume items.

- Diversify sourcing countries when possible to balance political and tariff risks.

- Choose OEM suppliers who are experienced with export documentation and customs compliance.

Frequently Asked Questions (FAQ)

What’s the difference between MFN and general tariff rates?

MFN (Most-Favored-Nation) rates are preferential tariffs granted to trade partners, typically lower than general rates, which apply to countries without such agreements.

How do I classify ceramic bowls for customs?

Use the Harmonized System (HS) codes. Kitchen-use bowls typically fall under HS Code 6912.00, while decorative ones might be under 6913.10. Check with customs brokers for accuracy.

Are anti-dumping duties permanent?

No. ADDs are subject to review every 5 years or after trade investigations. However, they can last years and significantly affect import costs.

Can I avoid tariffs with Free Trade Zones (FTZs)?

Yes, FTZs allow goods to be stored or processed without immediate payment of tariffs, which can offer flexibility in re-export or repackaging strategies.

Do decorative ceramic bowls have lower tariffs?

In many countries, yes. Since they’re considered non-essential or non-functional, decorative bowls often attract lower duty rates than functional kitchen items.

Aligning Your Sourcing with Tariff Realities

As international demand for ceramic bowls continues to grow—from minimalist noodle bowls to artisan-inspired glazed serving dishes—importers must approach sourcing with both design and duty in mind. Tariffs aren’t just numbers—they shape your retail pricing, your margins, and even the regions you choose to sell in.

For kitchenware importers, gifting brands, and e-commerce sellers seeking custom solutions that meet both aesthetic and trade compliance needs, it’s wise to partner with a ceramic manufacturing factory in China that offers OEM & ODM services and understands the evolving global tariff landscape.

Such partnerships can help streamline everything from product development to HS classification to export logistics—making your business more resilient, more efficient, and more profitable in a tariff-heavy world.