In today’s globalized economy, manufacturers looking to export products to international markets must consider a wide array of factors. One of the most significant of these factors is import tariffs. For companies that manufacture and export goods, understanding the implications of import tariffs can have a substantial impact on pricing, profitability, and overall market strategy. This is particularly true for manufacturers looking to penetrate the Middle Eastern market.

The Middle East presents a growing opportunity for manufacturers, but navigating the complex world of tariffs can be challenging. In this blog post, we’ll explore the intricacies of import tariffs in the Middle East and discuss strategies manufacturers can adopt to stay competitive while meeting regulatory standards.

Understanding Import Tariffs in the Middle East

Import tariffs are taxes imposed by governments on goods brought into a country. These tariffs are often a tool used by governments to protect domestic industries, generate revenue, or influence trade balance. The Middle East, with its diverse range of economies and trade policies, requires manufacturers to be well-versed in the specific tariff structures of each country.

Unlike the European Union or the United States, where there are relatively standardized regulations across states or countries, the Middle East features a complex mix of individual country policies and regional agreements. This means that manufacturers must understand both the broad regional trade agreements, such as those under the Gulf Cooperation Council (GCC), and the specific import tariff laws in each country.

The GCC comprises six countries—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE)—that have a unified economic and customs union, but each country still maintains its own policies on certain matters. This makes it essential for manufacturers to differentiate between GCC-wide regulations and country-specific tariffs.

Why Tariff Knowledge is Critical for Manufacturers

Manufacturers looking to export ceramic products, like those produced by EKA, must be particularly attentive to tariff rules. Since the Middle East is a growing market for ceramics, especially for home goods such as dinnerware, bathroom accessories, and décor, manufacturers need to evaluate how import tariffs will influence their pricing structures, competitive advantage, and product positioning.

Some key reasons manufacturers should closely monitor import tariffs include:

- Cost Structure Impact: Tariffs directly affect the cost of importing goods. Higher tariffs mean higher overall costs for businesses, which can lead to price increases or reduced profit margins.

- Market Entry Strategy: Understanding tariffs can help manufacturers make informed decisions about entering specific markets. Certain countries may have low or no import tariffs for specific product categories, making them more attractive for investment.

- Competitive Advantage: Manufacturers who understand tariff structures can find ways to optimize their pricing, potentially undercutting competitors or offering more competitive products.

- Customs Compliance: Manufacturers need to ensure that their products comply with customs regulations to avoid delays and penalties. Non-compliance with tariff rules can lead to fines, rejections of shipments, or even bans on future trade.

Overview of Tariff Systems in Middle Eastern Countries

Each Middle Eastern country has its own import tariff policies, with different rates based on product categories. However, countries within the GCC have some commonality in their approach to tariffs, thanks to the Customs Union established by the GCC.

Let’s look at an overview of how tariffs work in key Middle Eastern markets.

Key Middle Eastern Countries and Their Import Tariffs

Below is a comparative overview of the import tariff policies in some of the most prominent Middle Eastern countries:

| Country | GCC Member | Average Import Tariff Rate | Notable Tariff Exemptions | Free Trade Agreements | Customs Duties on Ceramic Products |

|---|---|---|---|---|---|

| Saudi Arabia | Yes | 5% | Food items, medical equipment, industrial machinery | GCC Trade Agreement | 5% duty on most ceramics |

| United Arab Emirates (UAE) | Yes | 5% | Agricultural products, medical supplies | GCC Trade Agreement, CEPA with India | 5% duty on ceramic tableware |

| Qatar | Yes | 5% | Pharmaceuticals, machinery | GCC Trade Agreement | 5% duty on ceramic home goods |

| Oman | Yes | 5% | Certain luxury goods, specific agricultural items | GCC Trade Agreement | 5% duty on ceramics |

| Bahrain | Yes | 5% | Foodstuffs, medical devices | GCC Trade Agreement | 5% duty on ceramics |

| Kuwait | Yes | 5% | Raw materials, machinery | GCC Trade Agreement | 5% duty on ceramic products |

| Egypt | No | 10-20% | Goods from preferential trade partners | EU-Egypt FTA, Egypt-Turkey FTA | Higher tariffs on ceramics, up to 15% |

| Jordan | No | 10-30% | Food products, machinery | Jordan-US FTA, Jordan-EU FTA | 15% duty on most ceramics |

Key Insights for Manufacturers

From the above table, several insights emerge that manufacturers should consider when exporting ceramic products to the Middle East:

- Uniform Tariffs within the GCC: All GCC countries impose an average tariff of around 5%, which is relatively low. This makes the GCC region attractive for manufacturers, as they can export to multiple countries within the region at the same tariff rate.

- Diverse Policies Outside the GCC: Countries like Egypt and Jordan have higher tariffs, with rates that can vary from 10% to 30%. Manufacturers must consider these differences when planning to enter non-GCC markets.

- Product-Specific Tariffs: For ceramic products, the tariff rate is relatively consistent across GCC countries, but non-GCC countries may impose higher rates. This suggests that manufacturers looking to export to non-GCC countries should focus on cost-effective production to offset higher tariffs.

- Free Trade Agreements: The existence of free trade agreements (FTAs) can significantly reduce or eliminate tariffs on certain goods. Manufacturers should explore these opportunities to minimize their tariff liabilities.

Navigating Tariffs: Practical Strategies for Manufacturers

To successfully navigate the import tariffs in the Middle East, manufacturers should adopt the following strategies:

- Research Tariff Codes: Manufacturers must ensure their products are classified under the correct tariff codes. Incorrect classification can lead to higher-than-expected tariffs or delays in customs clearance.

- Optimize Supply Chain: Manufacturers should consider sourcing materials or components from countries with lower tariffs or better trade agreements. This can reduce the overall cost of production and mitigate the impact of import duties.

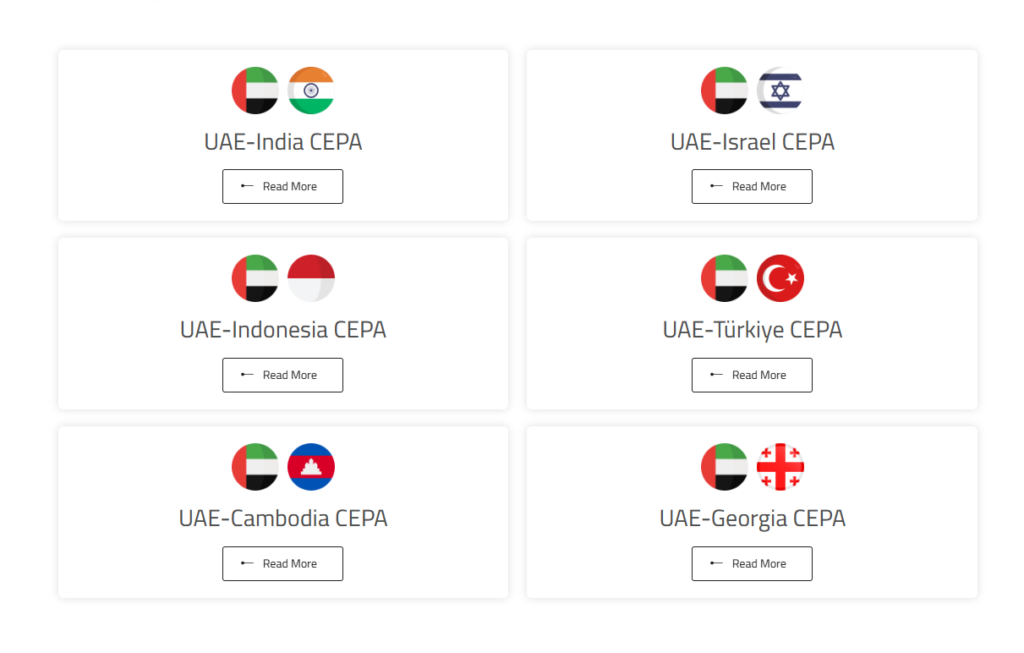

- Leverage Trade Agreements: Take advantage of regional trade agreements such as the GCC Customs Union or bilateral agreements like those between the UAE and India. Manufacturers should explore how these agreements can reduce or eliminate tariffs on specific products.

- Build Relationships with Customs Brokers: Having a trusted customs broker can ensure smooth processing of imports and help manufacturers stay compliant with ever-changing tariff laws.

- Consider Tariff Engineering: For more complex products, tariff engineering involves altering the product design or sourcing to qualify for lower tariff rates. While this requires expertise, it can offer significant savings.

Conclusion

Navigating import tariffs in the Middle East is essential for manufacturers seeking to expand their presence in this dynamic market. By understanding the intricacies of tariff rates, leveraging free trade agreements, and adopting effective strategies, manufacturers can reduce costs, stay competitive, and improve their chances of success in the region. With the growing demand for high-quality ceramic products in the Middle East, especially in home goods and décor, the opportunities for manufacturers are abundant. By staying informed and agile, businesses can successfully navigate the tariff landscape and capitalize on the region’s growth potential.

At EKA, we specialize in providing high-quality ceramic products, including dinnerware and home décor items, to global clients. We offer flexible OEM and ODM services to meet the diverse needs of our partners in the Middle East and beyond. Contact us today to learn how we can help you optimize your ceramic product strategy for the Middle Eastern market.