In recent years, South America’s ceramic tableware and kitchenware market has seen rapid growth, largely fueled by e-commerce. With the rise of Mercado Libre, Americanas, Magazine Luiza, and other platforms, consumers in Brazil, Argentina, and Chile are showing increasing demand for high-quality, diverse ceramic designs.

For overseas buyers, this market is full of opportunities, but also presents challenges in logistics, cultural adaptation, and pricing strategies.

Key Characteristics of the South American Ceramic E-Commerce Market

Culturally driven aesthetics and functional needs

South American tableware design is heavily influenced by both European immigrant culture and local traditions. For example, Argentine households favor large ceramic plates for steaks and barbecues; Brazilian consumers prefer brightly colored ceramics suited for festive occasions; Chilean buyers tend to go for simple, durable everyday dinnerware.

Argentine

Brazilian

Chilean

E-commerce platforms dominate distribution channels

The shift from offline retail to online sales is accelerating in South America. Mercado Libre — with its extensive logistics network covering the entire region — has become the go-to platform for ceramic brands entering the market. Meanwhile, local e-commerce giants like Americanas and Magazine Luiza are expanding their kitchenware categories and increasing visibility for tableware products.

Clearly segmented price tiers

The South American ceramic tableware market covers a wide spectrum — from affordable mass-produced pieces to high-end, limited-edition handmade collections. Middle-class households tend to buy premium dinnerware sets, while younger consumers often seek unique, design-focused single items.

Country Spotlight: Brazilian Ceramic Brands and Market Performance

Brazil is one of the largest ceramic producers and consumers in South America, known for its vibrant, colorful designs that blend tropical elements with modern styles.

| Brand | Style & Features | Product Highlights |

|---|---|---|

| Oxford Porcelanas | One of Brazil’s largest ceramic manufacturers | Full range of ceramic tableware, high color saturation, suitable for home and hospitality |

| Schmidt Porcelanas | High-end bone china & fine decoration | Classic European styles, gold rims, and intricate floral patterns |

| Porto Brasil Cerâmica | Rustic vintage style | Handmade texture glaze, warm tones, festive appeal |

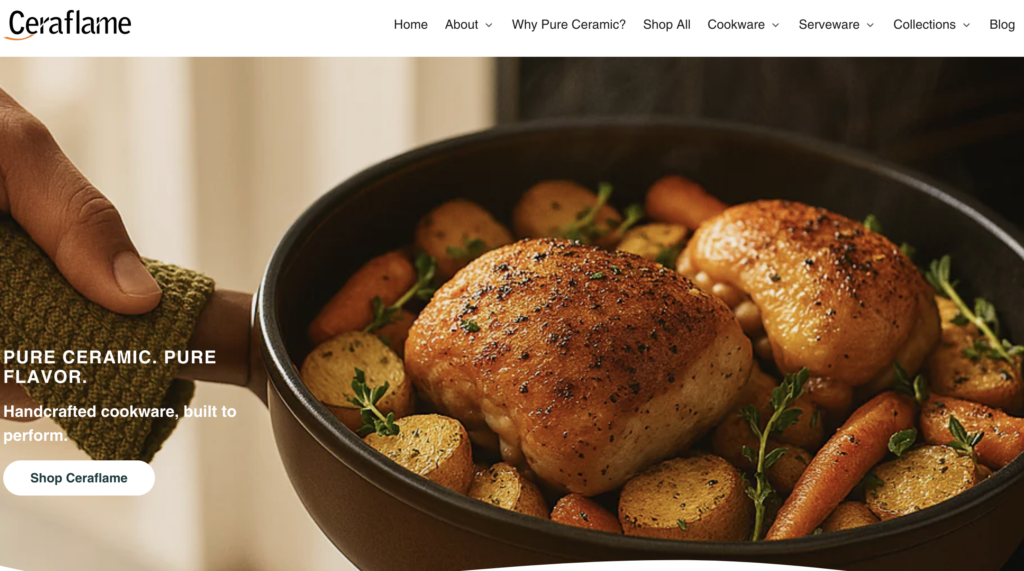

| Ceraflame | High heat-resistant cookware | Stove-top safe ceramic pots, strong functionality |

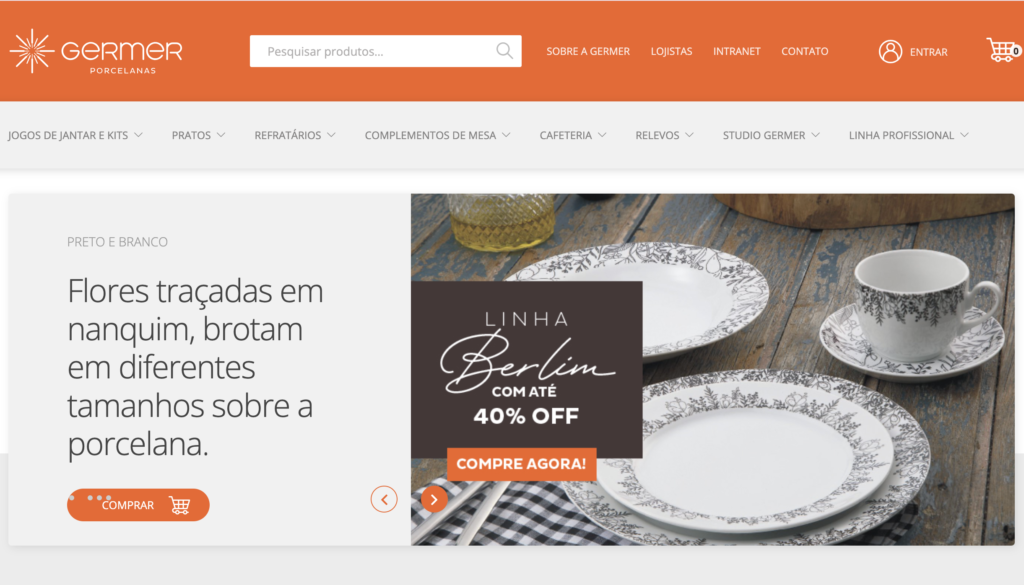

| Germer Porcelanas | High durability | Simple, long-lasting designs for the foodservice industry |

Sales data from Mercado Libre and Americanas show that Brazilian consumers are highly receptive to brightly colored, patterned ceramic products, while functional cookware (such as heat-resistant pots) also performs well.

Comparison of Major E-Commerce Platforms in South America

| Platform | Market Coverage | Main Consumer Groups | Price Range | Trending Features |

|---|---|---|---|---|

| Mercado Libre | Brazil, Argentina, Chile, Uruguay, etc. | All demographics | All price ranges | Large search traffic, ideal for rapid product testing |

| Americanas | Primarily Brazil | Middle-class & family users | Mid-range | Strong preference for dinnerware sets and holiday bundle promotions |

| Magazine Luiza | Brazil | Young urban families | Mid-range | Focus on brand reputation and fast delivery |

| Falabella | Chile, Peru, Colombia | Middle- to high-income groups | Mid-high | Preference for imported and designer pieces |

| Linio | Colombia, Peru, Mexico | Younger shoppers | Mid-low | Suited for functional and value-for-money products |

Trend Insights:

- Mercado Libre is the best entry point into the South American ceramic e-commerce market due to its wide reach and high traffic.

- Brazilian consumers strongly prefer dinnerware sets, while younger shoppers in Chile and Argentina enjoy purchasing single, statement pieces.

- Localized holiday promotions (e.g., Brazilian Carnival, Mother’s Day) can significantly boost sales.

Consumer Preferences in Design and Functionality

Best-selling ceramic kitchenware features in South America include:

- Bright colors and patterns (matching festive and tropical vibes)

- Large plates (ideal for steak and barbecue)

- Functional cookware (heat-resistant, stove-safe)

- Eco-friendly and lead-free materials (appealing to high-end households and export markets)

Market Entry Recommendations for Overseas Buyers

- Platform entry sequence: Start with Mercado Libre to test the market, then expand to Americanas and Falabella.

- Product mix strategy: Offer colorful sets in Brazil and single-piece limited editions in Chile and Argentina.

- Localized design: Tableware with tropical plant and animal motifs has strong appeal in South America.

- Holiday stock planning: Prepare inventory at least three months ahead for Brazilian Carnival, Christmas, and other peak seasons.

FAQ

Q1: Do South American consumers care about the country of origin for ceramic tableware?

Yes, especially high-end buyers who value imported goods and brand heritage.

Q2: Is the breakage rate high when shipping ceramics to South America?

Yes, without specialized packaging, breakage rates are higher than domestic deliveries. Extra protection is essential.

Q3: What colors sell best in Brazil?

Bright red, sunshine yellow, peacock blue, and tropical floral prints are most popular.

Q4: Which is more profitable: Mercado Libre or Americanas?

High-end products tend to yield better margins on Americanas, but Mercado Libre offers stronger sales volume.

Q5: How can overseas sellers reduce logistics costs for ceramics in cross-border e-commerce?

Consider using local fulfillment centers or partnering with local distributors.

Conclusion

The South American ceramic e-commerce market has huge potential, particularly in Brazil, Argentina, and Chile. The combination of mature platforms and improving logistics networks gives overseas buyers excellent opportunities. From Brazil’s colorful tableware to Argentina’s refined plates and functional ceramic cookware, there’s a buyer segment for every style.

As a ceramic tableware manufacturer based in China, we provide OEM & ODM orders for global kitchen and home brands, tailoring products to South American cultural, color, and functional preferences — helping buyers succeed in emerging markets.